Save $588 per year with Sponsored Premium

Currency correlation

Forex Fundamental AnalysisJoin Tradimo's Premium Club And Choose a Membership Right For You.

- 1,000+ hours of videos, quizzes & projects

- 150,000+ students rate our courses 4,8/5 every month

- Private access to trading & investing mentorship

- Trading & investing signal community with 40% return p.a.*

- Completion certificate for your resumé & LinkedIn

The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk.

Currency correlation

Currency correlation happens when the price of two or more currency pairs moves in conjunction with one another. There can be both positive correlation, where the price of the currency pairs moves in the same direction and negative correlation, where the price of the currency pairs moves in opposite directions.

As a forex trader, it is important to understand the relationship between currency pairs, because currency correlation can affect the exposure and risk to your trading account.

Currency pairs incorporate two economies

Currency pairs are made up of two separate currencies and they are valued in relation to each other. Each currency belongs to an economy that can affect the supply and demand of it. If the value of one currency increases (or decreases), it increases (or decreases) across the board against all other currencies, not just a single one. For example, if the euro increases in value against the US dollar, it is likely to increase in value against all other currency pairs as well, not just the US dollar. This means that currency pairs cannot be traded in isolation.

Currency pairs are made up of two separate currencies and they are valued in relation to each other. Each currency belongs to an economy that can affect the supply and demand of it. If the value of one currency increases (or decreases), it increases (or decreases) across the board against all other currencies, not just a single one. For example, if the euro increases in value against the US dollar, it is likely to increase in value against all other currency pairs as well, not just the US dollar. This means that currency pairs cannot be traded in isolation.

This does not mean that a currency value will change at the same rate against all other currency pairs. For example, if the euro rises against the US dollar by 100 pips, it does not mean that there will be a 100 pip increase against the Australian dollar. However, it will likely rise against the Australian dollar to a certain degree.

Positive correlation

Positive correlation means that two currency pairs move in the same direction – if one currency pair moves up, so does the other. To illustrate this, let's take the example of the EUR/USD and the AUD/USD.

The EUR/USD is made up of the euro and the US dollar. If the price of EUR/USD increases, this can mean that either the euro is in more demand or the dollar is in less demand. Either scenario will result in the price of the euro increasing against the dollar.

If there is less demand for the US dollar, then there will also be less demand for the US dollar against other currency pairs, because there will be less demand for the US dollar overall – it does not become weaker against one currency only.

If the EUR/USD increases because the USD has become weaker, you can expect that the AUD/USD will also increase. This is an example of a positive correlation between the EUR/USD and AUD/USD.

Negative correlation

Negative correlation means that two currencies move in the opposite direction to each other – if one currency pair moves up, the other moves down. To illustrate this, let's use another example, this time of the EUR/USD and USD/JPY.

If the demand for the dollar decreases, then the price of the EUR/USD will increase, whereas the USD/JPY will decrease. This is because the price of the USD is denoted differently for these two currency pairs. US dollar weakness will be shown as an increasing price for the EUR/USD and seen as a decreasing price for USD/JPY.

Trading more than one pair at a time

Due to correlation between different currency pairs, there are considerations that you have to take into account when trading more than one currency pair.

Currency correlation can increase the overall risk to your trading account

Let’s say that you risk 2% of a trading account on a single trade. If you open a long position on both the EUR/USD and the GBP/USD, then it would appear that you have opened up two trades with a 2% risk on each.

Let’s say that you risk 2% of a trading account on a single trade. If you open a long position on both the EUR/USD and the GBP/USD, then it would appear that you have opened up two trades with a 2% risk on each.

However, because there is a positive correlation between the EUR/USD and GBP/USD, if one currency pair moves in one direction, the other currency pair is likely to as well. This means that if one currency pair moves against your trade, the other will too. Because you have risked 2% on each trade that is correlated, this is effectively the same as risking 4% on a single trade.

Correlating trades can cancel each other out

If a trader opens up a long position on the EURUSD and a short position on the GBP/USD, then because they are likely to move in the same direction, one will produce a profit and the other will produce a loss. Any profit made on one trade would be offset by the loss on the other. Opening up opposite positions on a strongly correlated currency pair is counter-productive.

Similarly, if a trader opens the same position on a negatively correlating pair, such as the EURUSD and the USD/JPY, then if one position results in a profit, the other will result in a loss. Any profit gained on one trade is likely to be offset from the loss on the other.

Correlations can be measured

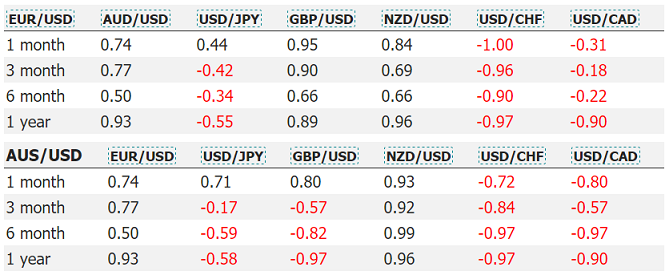

The correlation between currency pairs is not exact. Depending on the fundamentals behind them, a currency correlation can become stronger or weaker – they can also break down completely. The financial industry generally measures correlations using a scale from +1 to -1:

- +1 = perfect positive correlation

- -1 = perfect negative correlation

- 0 = no correlation at all

Using currency correlation to your advantage

Currency correlation can hold advantages when trading, because observing one currency pair can give you an insight into another, if they are correlated.

Confirming trades and analysis

Correlation can be used to confirm a trade, or your analysis, on a particular currency pair. Correlation is never exact and so you are looking for the same ‘kinds’ of moves, but they will not be exactly the same for each currency pair.

The idea is to look at whether the positively correlating pairs are moving together with the currency pair that you are watching. So if you are observing a currency pair move down, you can use other currency pairs that positively correlate to see if they are also moving down, confirming that your analysis is correct.

To illustrate, let's say that you are observing the EUR/USD pair. You observe that the price is moving down and you are considering whether to enter a short trade. You can use positively correlating currency pairs, such as the AUD/USD and GBP/USD, to see if there is a similar down trend occurring.

If there is, that means that the move is most likely due to a fundamental factor, making it more likely that a trend will be established. This may make you feel more confident about the trade on the EUR/USD.

The chart below shows an example of all three currency pairs moving in the same direction, making it more likely that a short trade will work out.

- EUR/USD is declining

- AUD/USD confirms downtrend

- GBP/USD confirms downtrend even further

Avoiding bad trades

Correlation can also be used to keep you out of bad trades, such as a false breakout.

If you are observing a currency pair that has been in a range and you observe a breakout to the upside, you can use positively correlating pairs to see if they have also broken to the upside.

Let's look at another example using the EUR/USD, AUD/USD and the GBP/USD. In the following chart you can see that the EUR/USD had been trading in a range and broke to the upside, marked by 1:

- EUR/USD is breaking out

- At the same time, the AUD/USD is moving in the opposite direction

- GBP/USD is also not breaking to the upside

You can see that even though there is a breakout on the EUR/USD, there is no confirming movement on the AUD/USD or the GBP/USD. You can also see that after a very short time, the EUR/USD then fell. By using currency correlation, you can avoid bad trades.

Summary

So far, you have learned that:

- currency correlation happens when two or more currency pairs move in conjunction with one another.

- positive correlation between currency pairs means that the price of each currency pair moves in the same direction. Negative correlation between currency pairs means that the price of each currency pair moves in opposite directions.

- currency pairs are made of two separate currencies. Each one belongs to an economy that can affect the supply and demand of it.

- currency pairs cannot be traded in isolation because if a currency rises in value, it will rise in value across all other currencies to a degree, not just one.

- currency correlation can result in increased risk when trading two or more strongly correlated pairs.

- currency correlation can also result in trades cancelling each other out.

- correlation can be measured with +1 being a perfect positive correlation, -1 being a perfectly negative correlation and 0 being no correlation at all.

- you can confirm your trades, or analysis, by looking for the same movement on positively correlated currency pairs to the currency pair that you are observing.

- currency correlation can also be used to avoid false breakouts.