Triple candlestick patterns: morning and evening star

In the following lesson, you will learn how to interpret more complex candlestick patterns using three candles to determine price reversals.

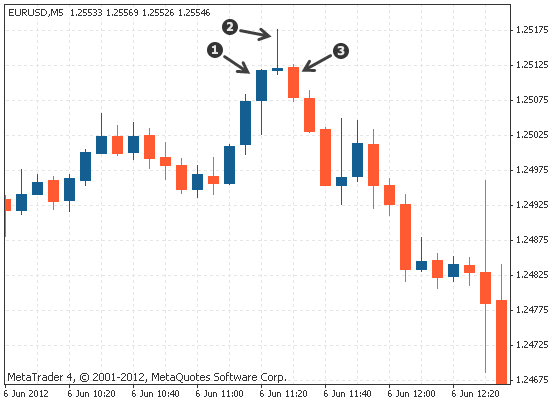

The morning star candlestick formation

The morning star is a reversal pattern to the upside that can be found at the end of a downtrend. The following chart shows an example of a morning star pattern:

- The first candlestick is bearish.

- The second candlestick has a small body. It does not matter if the second body is bullish or bearish (although a bullish body with a small or no upper wick indicates more bullish power). The small body serves as an indicator that the bears are losing their capacity to drive the market lower. It is also possible for the second candlestick to have no body (a doji).

- The third body is bullish that closes within the first candlestick, preferably beyond the halfway point of the first candlestick. This shows that the bulls are gaining control.

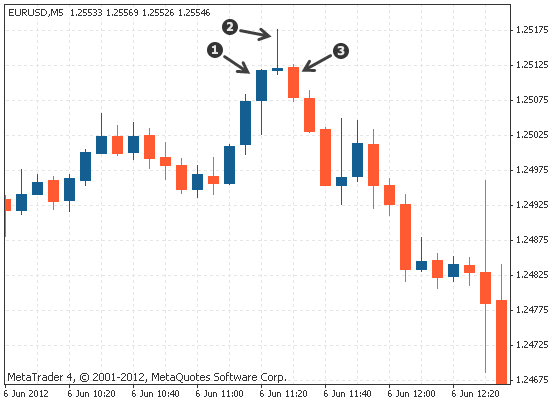

The evening star candlestick formation

The evening star is the bearish counterpart of the morning star pattern. The evening star is a reversal pattern and appears after an uptrend. The following chart shows an example of an evening star pattern:

- The first candlestick has a strong bullish body.

- The second candlestick has a small body. It can be bullish or bearish. It is also possible for the second candlestick to have no body (a doji).

- The third candlestick has a strong bearish body and closes within the body of the first candlestick, preferably beyond the halfway point of the first candlestick in the pattern.

Summary

So far, you have learned that:

- the morning star and evening star are reversal patterns.

- the first candlestick is in the direction of the trend.

- the second candlestick can be bullish or bearish and has a small body, denoting indecision in the market.

- the third candlestick is a candlestick in the direction of the reversal, closing preferably beyond the half way mark of the first candlestick.